Rakesh Jhunjhunwala was a famous figure in India’s stock market, and once held immense power in finance. Known widely as the “Big Bull of Dalal Street,” his path from simple beginnings to a wealthy investor is truly encouraging. Now, let’s explore the life and work of this remarkable man who greatly impacted India’s financial scene.

In this article, we will cover:

- Introduction

- The Rise of the Big Bull

- Jhunjhunwala’s Investment Philosophy

- The Rakesh Jhunjhunwala Net Worth

- Comparison with Warren Buffett

- The Harshad Mehta Connection

- Insider Trading Allegations

- The Legacy of Rakesh Jhunjhunwala

Introduction

People know Rakesh Jhunjhunwala as the “Big Bull of Dalal Street“, a giant in India’s stock market. He started with little and became a billionaire investor. His clever investments and strong faith in India’s economy led him to success. Jhunjhunwala’s effect on the stock market is hard to ignore. His hopeful outlook and smart investments guided the market’s path.

Every move he made was watched closely by investors. They used his investments as a way to gauge the market mood.

Yes, Rakesh Jhunjhunwala is famous, but his journey had its own issues. This blog will go deep into his life, his career, his investment thinking, and the problems that came his way.

The Rise of the Big Bull

The Rise of the Big Bull

Rakesh Jhunjhunwala, born July 5, 1960. He grew up in a Marwari family from Rajasthan where business was the heartbeat. His father’s role as an income tax officer kindled a fire in young Rakesh, a fascination for the stock market.

Fresh out of Sydenham College, Mumbai, he turned to his calling. Charting a course in accountancy wasn’t enough for him. He took Rs. 5,000 in 1985 and dove into the world of investment.

Rakesh was a newbie, eager to learn and grow. He would study the market, inspect companies, and begin to understand the dynamics and flow of the stock market. Briefly, he made small gains, small steps towards the financial giant he would one day become.

Over time, Rakesh’s investment understanding grew stronger. The knack he had for picking up underpriced stocks and holding onto them turned into a winning game plan. He made big leaps with companies like Titan Company and Star Health and Allied Insurance. Titan was a sinking ship that began to sail again; Star Health was a beacon of bright prospects. Through these, Rakesh wasn’t just gaining wealth, but also cementing himself as a visionary investor. From there, his fame sky-rocketed. People began to know him as the “Big Bull,” a title that mirrored his optimistic vision of India’s stock market.

So popular he became, that every move he made would be studied by eager investors. Rakesh Jhunjhunwala, the common man from Rajasthani family who turned Rs. 5,000 into an investment empire. He was a master in his approach, solid in his results, and an inspiration for everyone.

Investment Philosophy

Jhunjhunwala’s Investment Philosophy

Rakesh Jhunjhunwala had faith in long-term investing over fast money.

He hung onto stocks, letting them grow over time. His knack for finding strong companies was his winning secret.

His stock picks were carefully chosen. He checked the company’s operations, management, and finances. Strong growth potential, competitive edge, and fair pricing were his go-to’s. His investment ideas were simple. Good performance by a company’s business equals good stock market standing.

Despite taking big chances, Jhunjhunwala was no stranger to handling risks. He spread his assets across various sectors, and kept a good chunk of his wealth easily accessible. This helped him keep his head above water during tough times.

Success stories like Titan Company are testament to his sharp investment skills. Titan, once a failing company, became a titan of the market under his guidance. Similarly, his investments in Lupin, a drug company, and CRISIL, a credit rating firm, were big hits. This made him a respected figure in the investing world.

Jhunjhunwala contributed to India’s startups too. His venture capital firm, Rare Enterprise, invested in early-stage companies, encouraging budding entrepreneurs. It was a reflection of his can-do spirit, and his faith in India’s bright future.

Rakesh Jhunjhunwala: Net Worth

The Rakesh Jhunjhunwala Net Worth

Starting with a mere Rs. 5,000, Rakesh Jhunjhunwala climbed to billionaire status. Smart choices and belief in India’s growth fueled his success.

At his career’s height, he was among India’s wealthiest. The media spotlight followed, making him a guide for budding investors.

Besides wealth, Jhunjhunwala led a lavish life. From fancy cars to private jets and gourmet meals, his lifestyle was awe-inspiring. An estimated net worth of $5.8 billion (Source: Wikipedia) signified his investment foresight. Yet, he was more than just a billionaire. Jhunjhunwala felt driven to help others. He gave generously to charities, focusing on health and education. His philanthropic efforts changed many lives.

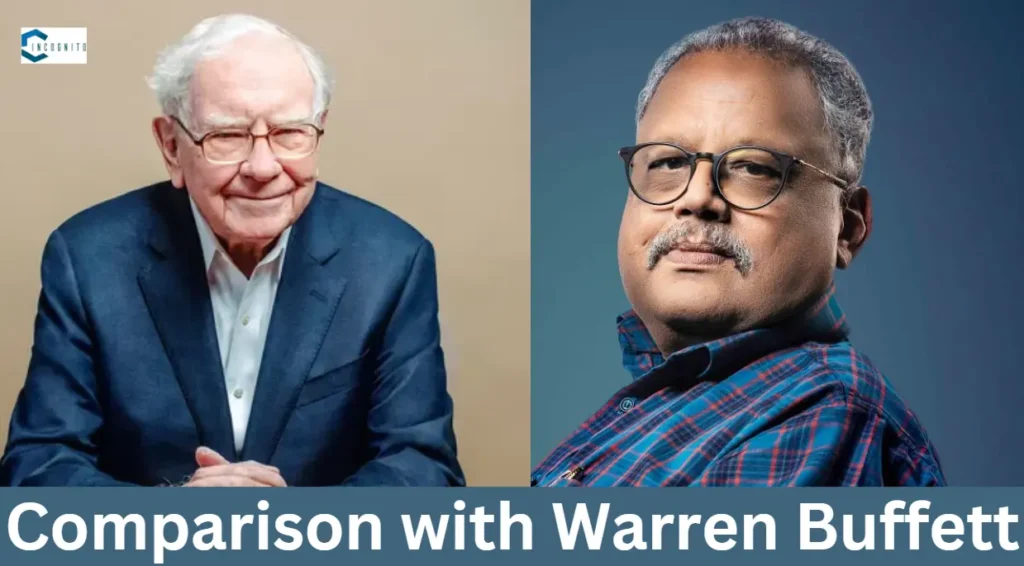

Rakesh Jhunjhunwala and Warren Buffett

Comparison with Warren Buffett

People often said Rakesh Jhunjhunwala was like Warren Buffett, the famous investor. That’s why they used to call him “India’s Warren Buffett.”

Both men had similar ways of putting their money to work. They looked for long-term value and weren’t in a rush. They studied the companies carefully before investing.

But Jhunjhunwala said they weren’t just alike. Buffett made his wealth over time by putting his money in less costly American companies. Jhunjhunwala, however, invested in the quickly changing Indian market. This market was different from the US market, it was changing fast and had special features.

Also, Buffett was more careful with his investments. Jhunjhunwala, on the other hand, took more risks. Even though people compared the two, both left a mark that will last. Many who invest will want to be like them.

Rakesh Jhunjhunwala and Harshad Mehta Connection

The Harshad Mehta Connection

Harshad Mehta’s name brings to mind a major financial scam in India’s past.

In the early 90s, he set up a huge securities fraud. He rigged stock prices and stole countless rupees. This shook India’s financial world and damaged people’s trust in stocks.

Moving forward, Rakesh Jhunjhunwala rose to prominence in the stock market. There were times when his name was associated with Mehta’s scandal. However, there’s no solid proof that Jhunjhunwala had any part in Mehta’s crimes. It’s important to consider that they had different ways of doing things in the market. But, the Harshad Mehta scam put a heavy cloud over the stock market in India. This scandal highlighted systematic flaws within the financial world.

This led to a need for regulatory improvements. After the scandal, investors became more watchful, so the market went through a rocky time. Jhunjhunwala managed to find his way through these uncertain times. He managed to build a successful career despite the marks left by the Harshad Mehta saga on India’s financial scene.

Rakesh Jhunjhunwala and Insider Trading Allegations

Insider Trading Allegations

Even Rakesh Jhunjhunwala, a powerhouse in investing, faced some sticky situations. Big charges of insider trading challenged his standing.

The most talked-about one? A scandal with Aptech, a software company. Jhunjhunwala and his family owned lots of Aptech shares. The Securities and Exchange Board of India (SEBI) thought something fishy was going on. They investigated and found hints that Jhunjhunwala might have used privileged Aptech info for profit.

Yes, the scandal was a big deal in the news. But it was finally handled outside of court. To solve it, Jhunjhunwala and his family paid a hefty amount to SEBI. It’s key to understand that a settlement isn’t the same as admitting wrong. Many times, it’s a smart move to skip the long legal duel and potential harm to business and reputation.

But the Aptech situation wasn’t the only time people questioned Jhunjhunwala. Doubts came up on other investments too. Some wondered if his tight ties with specific companies and his sway on stock prices could involve some market mischief. But, no one could ever truly prove these claims.

Although the trading suspicions did smudge Jhunjhunwala’s reputation a bit, they also reminded everyone that even the best investors can face challenges.

The Legacy!

The Legacy of Rakesh Jhunjhunwala

Rakesh Jhunjhunwala was a giant in the Indian stock market. He had a keen eye for investing, which drew other investors and overseas money. His work helped make India a major player in global finance.

His death in 2022 had a huge impact. People really felt his loss. The market struggled a bit after he was gone, missing its “Big Bull.” But his ideas about investing still guide people today. Jhunjhunwala didn’t start off rich. He made his own wealth, and it showed others what was possible. He taught others how investing wisely could lead to big payoffs. He became a guide, pushing others to take smart risks and trust in India’s economy.

However, it’s worth noting some problems with Jhunjhunwala’s career. There were rumors about insider trading and ties to Harshad Mehta. Some wondered if he always acted ethically. But these issues should not overshadow his big contributions.

Jhunjhunwala was a complicated man, but his changes to India’s stock market will last a long time. He was forward-thinking, courageous, and generous. His story goes to show the power of dreams and self-belief. Even though he’s gone, his spirit keeps encouraging people to aim high.

Thank you, for reading. For more blogs like this, stay tuned.

Stock Market Crashed On Monday: Here’s What You Need To Know