The financial world has seen noteworthy changes due to the progression of technology over the past few years. With the creation of the primary cryptocurrency, Bitcoin,” in 2008, markets have since changed in a shocking way, with rising investment instruments making radical impacts on economies. In this article, we are going to investigate the basic differences between Bitcoin and traditional currency to see how the rise of crypto might alter the entire world.

How did money evolve from barter to crypto?

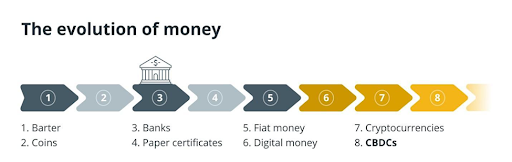

The earliest sorts of currency were objects of trade, such as stones and animals. These tradeable objects served as mediums for exchange and were valued according to their utility, shortage, request, and supply. Essentially, individuals traded what they needed with what they had.

As human settlements extended and individuals started to state ownership over their environment after the agricultural revolution, concepts like the economy, exchange, and eventually money emerged. Over time, individuals made the real money that we are utilizing, called fiat money.

What is traditional currency?

Traditional currency, or fiat money, could be a frame of cash that’s centralized, backed, and managed by a government. Modern fiat cash is intrinsically not tied to a physical product like gold or other savings. Instead, its esteem is based on an open belief in administrative and central-keeping money teachings, which have the specialist control the cash supply through measures like printing more money or altering interest rates. In other words, it is non-transferable and requires intrinsic value.

At that point came the explosion of technology, with blockchain biological systems driving the transformation, leading to the coming of cryptocurrency.

What is cryptocurrency?

A cryptocurrency could be computerized or virtual cash secured by cryptography (the art of encrypting and decrypting data).

Cryptocurrencies are regularly exchanged on decentralized computer networks among people with advanced wallets. These exchanges are freely recorded on conveyed, tamper-proof records called blockchains. This straightforward system anticipates duplication of coins and eliminates the need for a central authority, a bank, for instance, to approve exchanges.

Bitcoin was the primary cryptocurrency made and is presently the most prominent coin. It was launched in January 2008 by the pseudonymous program builder Satoshi Nakamoto. Over a long time, various other coins have developed, each with diverse characteristics, consensus mechanisms, and utilities.

Bitcoin vs. Traditional Cryptocurrency: Key Differences

- Value and Volatility:

Fiat currencies, by and large, offer more value stability than cryptocurrencies. One dollar you hold today will still be one dollar tomorrow, whereas the Bitcoin price can shift from day to day and indeed from minute to minute. A single BTC was worth almost $100 in 2013. Its esteem developed to a surprising $40,000 in 2021, some time recently diving nearly 45% of its esteem the year after. It’s presently valued at $60,987 per BTC, down more than 17% from its all-time high of $73,783 on March 14, 2024.

- Control:

Traditional currency is totally centralized because it is issued, sponsored, and overseen by a government entity. Bitcoin, on the other hand, was created to be decentralized. It uses blockchain technology to eliminate the need for a central authority or third party.

- Regulation:

Fiat currencies are intensely directed by central specialists, with well-established and clear controls to protect them against extortion, cash washing, and other unlawful exercises. In the interim, controls for cryptocurrencies in common are vague and proceed to advance. This causes uncertainty and volatility in markets, ruining the improvement of cryptocurrencies as investors and engineers hesitate to require activity.

- Accessibility:

Transferring fiat money from countries to nations can be moderate and costly because it requires intermediaries.

Bitcoin makes it conceivable for everyone around the world to create exchanges and buys for products and services because it is based on blockchain innovation. Individuals don’t require a bank account or identification, which are not accessible to lots of individuals, to form an exchange around the world and 24/7.

- Adoption:

Traditional currency can be utilized to purchase any kind of product or administration, whereas not every country in the world supports Bitcoin as an installment or product. On the off chance that you want to utilize Bitcoin for an exchange, you will have to change it to fiat currency.

- Privacy:

There are thousands of ways that a fiat transaction can be followed back to the party making that transaction. Cryptocurrency transactions, in any case, are transparent (viewable on the open blockchain) but nearly inconceivable to be followed as you merely see the wallet addresses of the senders and recipients.

- Security:

Fiat currency is frequently put away in banks and secured by lawful authorization. In any case, large-scale theft is possible. Bitcoin, be that as it may, may be computerized cash without a physical reserve and is secured by advanced cryptography that makes it impossible to fake. Exchanges are straightforward and unchanging, and crypto wallets are about impossible to get to unless somebody has your private key to the wallet. Be that as it may, the decentralized and poorly regulated nature of cryptocurrencies can be a prolific target for scams.