Have you ever been at the checkout line of a store and mentally reached into your pocket but your wallet was not there because you left it on your home? Perhaps it is time to leave that clumsy wallet that always remains filled with receipts and loyalty cards. Millions of people worldwide are using Apple Pay for contactless payments.

But how does Apple Pay work or more importantly how does it make your life easier? In this blog, you will learn all about it, starting from its basic features and its security and the advantages that the users have.

Contactless Payments

What is Apple Pay?

It is a secure and convenient mobile payment and digital wallet service developed by Apple for its users only and allows you to make contactless payments in stores within apps, and on websites using your iPhone, iPad, Apple Watch, or Mac. Let’s understand its key functionalities and explore the features that make it a game-changer:

Key Features:

Contactless Payments:

Swiping’s over! Apple Pay works by the use of NFC which enables your payment details to be transmitted directly to the compatible payment terminals. Merely bring your iPhone or your Apple Watch close to the reader and pay using Face ID or Touch ID.

Digital Wallet:

It is not limited to credit cards only. It acts as a comprehensive digital vault for all your financial essentials.

- Credit, Debit & Prepaid Cards: Currently, enroll your credit, debit, and prepaid cards for easy use in stores, through in-apps, and online.

- Transit Passes: The holidays are no longer a time when you have to be struggling for your travel card blindly. Save your transit pass in Apple Pay so that it can easily be used in public transportation systems.

- Loyalty Programs: Feeling annoyed with a few loyalty cards that you are supposed to provide at the definite stores? Tell your favorite loyalty programs to link to Apple Pay and earn points while you don’t think about it.

- Student IDs: They don’t understand that, at some universities, students are even allowed to link their student ID to Apple Pay for identification.

Seamless Integration:

User experience is very important to Apple. It is relatively easy to add cards to an Apple Pay wallet. Here’s how it works:

- Simple Setup: If you own an iOS-based Apple device go to the Wallet app that is preinstalled on your device.

- Effortless Card Addition: Click the “+” blue plus symbol on the Go and follow the instructions to get your cards into it. There usually are verification processes when your bank receives information about your activity and your account’s balance.

- Quick Access: For payments using a tap or a click, your cards are easily accessible once you have added them.

Transit Mode

More Than Basic Payments:

It provides more than just basic payments.

- Express Transit Mode: This feature means that you can travel using transit with no hassle, no need for you to even unlock your iPhone or Watch to pay for the fare, all you need to do is double-click on the home, button.

- Reward Programs: Where applicable continue to earn points and other rewards from your other loyalty programs associated with it.

- Split Payments: (In iOS 15 and later versions Apple Pay Support) If you are lucky enough to have iOS 15.1 and above, you can use it to do the splitting in messages with friends or family members.

- Sending and Receiving Money: Apple Cash in iOS 11.2 enabled, it lets you send and receive money from friends and family by Apple Cash.

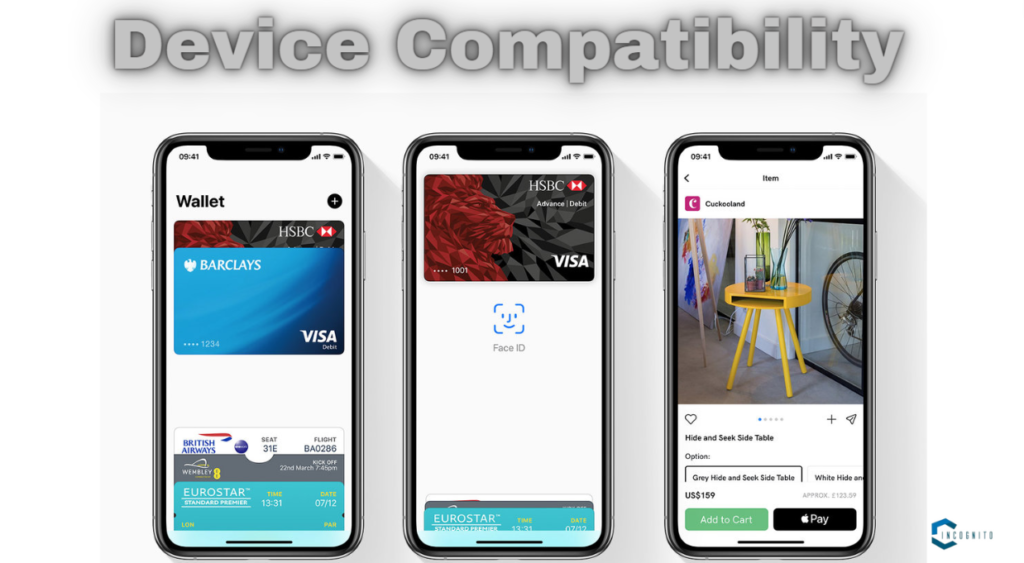

Device Compatibility

Getting Started with Apple Pay: How to Do Payments?

Set your sights on having the perfect freedom of Apple Pay to free yourself of the old-fashioned bulky wallet. Here’s a comprehensive guide to get you started in just a few simple steps.

Before You Begin:

- Device Compatibility: Optionally, make sure that you have the correct version compatible Apple device on hand. It is accepted with iPhone 6 and newer, iPad Air 2 and later generations, iPad mini 3 and newer, Apple Watch, and MacBook with touch or face Identity.

- Software Update: Make sure the devices you are using, iPhone, iPad, Apple Watch, or Mac have the correct OS version installed, iOS, iPad OS, watch OS, or macOS.

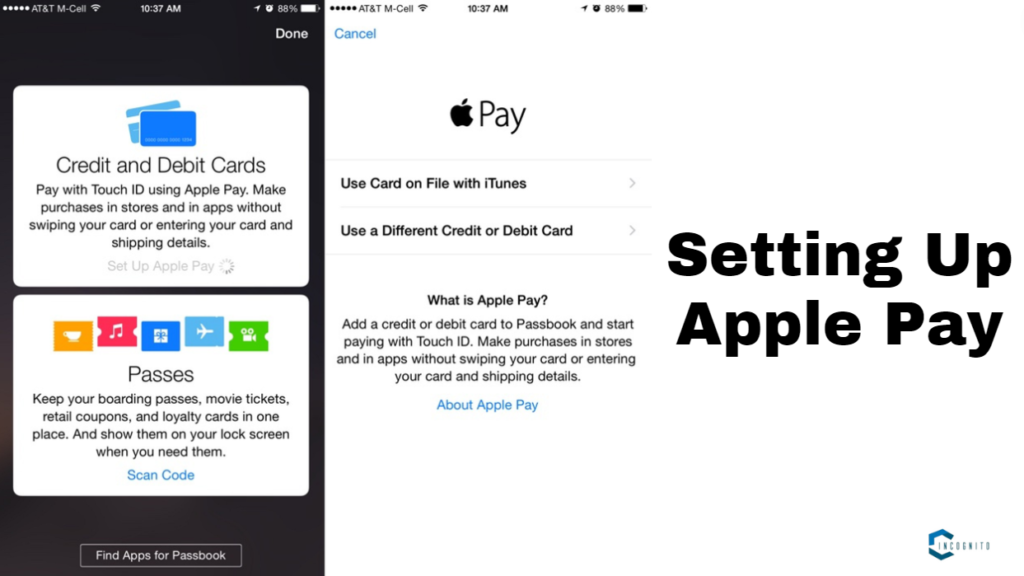

Setting Up Apple Pay

Setting Up Apple Pay:

1. Open the Wallet App: Find the Wallet app that is already installed on your Apple device. This is an Apple Wallet. This application is the master key that controls all your payments and digital passes within Apple Pay.

2. Add a Payment Method: There is a load button in the upper, right corner of the Wallet app, click on “+”. You’ll be presented with two options:

- Credit or Debit Card: Choose this if you want to include a new credit/debit/prepaid card to be linked with your Apple Pay uses. You can either, type the details of your card from the keyboard or allow your device’s camera to capture the information from the card.

- Previous Cards: By this time you may find Apple Pay connected with another device, if ever, and there would be an option that says “Add Previous Cards”. This enables one to easily enter the cards that he or she has used before without having to introduce them all over again.

3. Verify Your Information: Should you fill in the information that relates to your card, most likely your bank will request some confirmation to secure the input. This might include typing in a code sent via a text message or generating a code using the bank’s mobile application.

4. Set a Default Card (Optional): However, if you are using many cards in your Apple Pay wallet then you can select a preferred card for easy transactions. In order to choose a particular card, just tap on the card of your choice and that is it, you get a ‘Set as Default’ option.

5. Enable Apple Watch (Optional): If you are using an Apple watch you will be asked to add the newly added card while configuring the watch. It enables you to make payments right from the wrist of the watch without necessarily requiring the iPhone.

What are the Benefits of Using Apple Pay?

What are the Benefits of Using Apple Pay?

It offers a plethora of advantages for users:

- Convenience: Carry out the day-to-day transactions using an Apple device instead of a wallet and those thick bundles of cash. Say goodbye to digging in your pocket or carrying cards in your purse and then forgetting them at home!

- Speed: Payments are seamless, which is facilitated by the Near Field Communication technology. No more long queues of waiting to just swipe a card.

- Security: Taking care of its users is another feature that is exhibited by Apple Pay. The Venmo app for purchasing does not retain any of your financial data on the device plus, it does not share the data with merchants, which reduces the risk of fraud.

- Privacy: Unlike most other companies, Apple does not record your shopping history as a measure of ensuring clients’ confidentiality.

- Rewards: Keep accumulating points and rewards that are tied to the loyalty program of your Apple Pay.

Using Apple Pay for Everyday Purchases

Using Apple Pay for Everyday Purchases

It is incredibly versatile and can be used for a variety of purchases:

- In-Store Payments: Search for the contactless payment symbol (picture of waving Wi-Fi). Place your iPhone or Apple Watch against the reader and press the side button twice for Face ID or use Touch ID (iPhone or Apple Watch).

- In-App Purchases: Most of the apps allow purchasing products and services using Apple Pay conveniently. It is as simple as choosing Apple Pay as the form of payment at the time of checking out by just verifying it from the Face ID or the Touch ID.

- Online Payments: It is widely popular and can be used when paying for goods on most online shopping sites. When checking out look for the Apple Pay button and you will complete the transaction through your device.

How is the Security of Apple Pay?

Apple prioritizes user security with several robust features:

- Tokenization: Carrying out the actual credit or debit card information is never saved in the device that you use or give to the merchants. Now the unique Device Account Number is created for every transaction that is as much as four times smaller than the eight-digit number and it goes a long way in countering fraud attempts.

- Biometric Authentication: Payments must be iterated with Face ID or Touch ID making it secure only an authorized user can perform the transactions.

- Secure Element: One of the Apple devices generally has a chip known as a secure element chip which is just like a deposit where your payment details are safeguarded.

- Find My iPhone: For example, in case you lose your device, then you can be able to use Find My iPhone to lock or erase your Apple Pay information.

FAQs

1. Is Apple Pay safe?

Yes, It is one of the safest types of mobile payment services that a person can use. Combined with tokenization, biometric authentication, and SE chip, the theft cases are minimized.

2. What devices can I use with Apple Pay?

It currently supports iPhone 6 and above models, later models of iPad for example iPad Air 2, later models of iPad mini for instance iPad mini 3, and the Apple Watch and Mac computers that have Touch ID or Face ID.

3. Where can I use Apple Pay?

It can be used virtually everywhere credit is accepted, including ‘for purchases in the United States and more than 40 countries’. You will find the symbol contactless payment at the terminal when paying or the words ‘Apple pay’ during the payment process on the website.

4. Can I use multiple cards with Apple Pay?

Yes, you can add multiple cards.

5. What happens if I lose my iPhone or Apple Watch?

Find My iPhone can be used for locking or wiping the Apple Pay data to minimize the chances of the accounts being accessed by other people. Additionally, contacting your bank can help disable your cards if needed.