In March, the price of Advanced Micro Devices, AMD stock rose very high because investors got attracted to its computer chips for Artificial Intelligence.

AMD had a big change for the better after hitting a low point in 2015. They improved their products and made more money. AMD’s stock went way up over the next six years. But it went down starting in late 2021 because fewer people were buying personal computers. Last year, though, AMD’s shares went up again because people were excited about its chips for AI in big computer centers. They’re also expected to make money from people upgrading their computers because of AI.

The company was founded in May 1969 and launched into public in September 1972. It moved to a fabless semiconductor business in March 2009 by off-shooting its factories as Global Foundries (GFS).

Advanced Micro Devices New: AI Chips

Advanced Micro Devices New: AI Chips

AMD introduced its savvy MI300 accelerators and processors for data centers. These systems are used for high-performance computing and AI applications giving competition to Nvidia’s H100 series devices. AMD stock went down by 1.3% on the event day of its “Advancing AI.” But on the next day, December 7 shares went very high around 10%.

However, Nvidia beats AMD with its brand-new AI processors, which it introduced on March 18. The processors, the Blackwell series GPUs, will be available in late 2024. AMD stock went down after this news.

But AMD stock went higher on May 17 on news that Microsoft (MSFT) is going to offer its Azure cloud computing customers a platform of artificial intelligence chips instead of systems operating Nvidia chips.

On June 2 at the Computex trade show, Su announced that AMD plans to release new Instinct AI accelerators every year. Following the current MI300, they will launch the MI325X later this year, the MI350 in 2025, and the MI400 in 2026.

AMD Fundamental Analysis

On April 30, AMD paralleled Wall Street’s earnings target for the first three months but its sales were slightly lower. Moreover, its sales prospects for the next 3 three months were approximately matched with estimates. AMD went down by 8.9% in the next trading session.

In the March quarter, Advanced Micro Devices made 62 cents per share after adjustments, with sales totaling $5.47 billion. Analysts surveyed by FactSet had predicted earnings of 62 cents per share on sales of $5.48 billion. Compared to the same period last year, AMD’s earnings increased by 3% and its sales grew by 2%.

AMD predicted sales of $5.7 billion, more or less than $300 million. Analysts had been expecting Q2 revenue of $5.73 billion. In the year-earlier period, AMD recorded sales of $5.36 billion for that quarter.

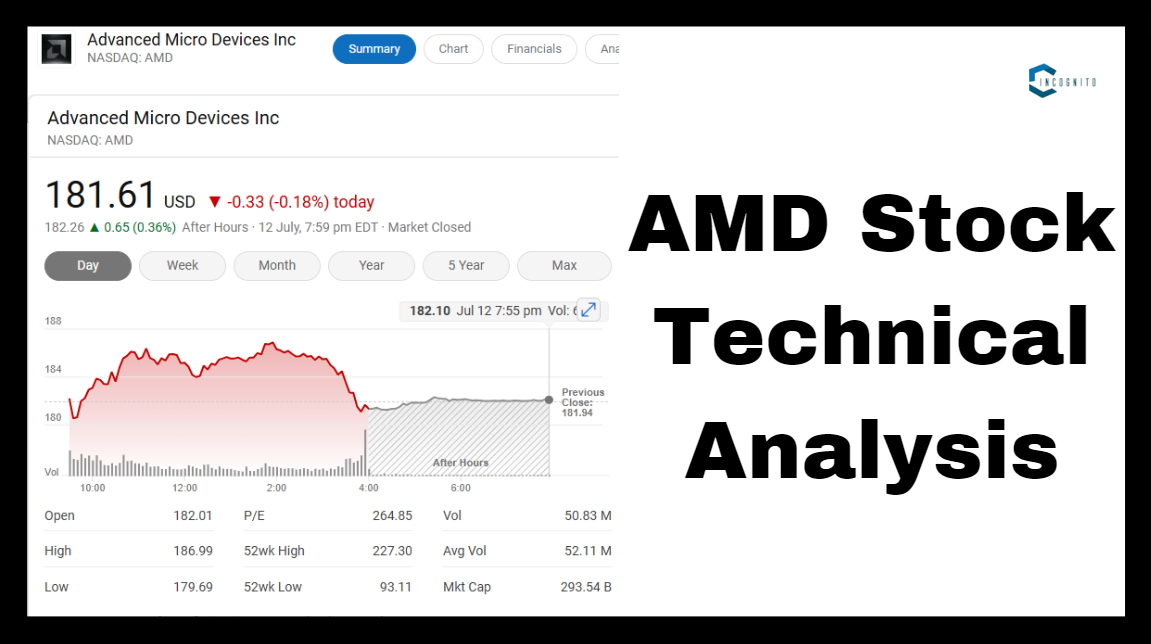

AMD Stock Technical Analysis

AMD Stock Technical Analysis

AMD stock dropped to around four sets of 10-year lows of 1.61 a share in July 2015 before setting up its grand recovery. In December 2021, it reached the highest-ever record of 164.46 due to the high PC sales during the COVID-19 pandemic.

AMD’s stock reached a high point of 227.30 on March 8 during trading hours. However, it dropped in the following 4 weeks, below its 50-day moving average. It has since recovered to that significant level.

Advanced Micro Devices shares closed at 183.96. at the end of the regular trading session on July 10.

AMD gained an IBD Relative Strength Rating of 93 out of 99. The Relative Strength Rating determines how a stock’s price performance is collected against all other stocks over the last 52 weeks. The ideal growth stocks generally have RS Ratings of a minimum of 80.

AMD stock holds an IBD Composite Rating of 94 out of 99. IBD’s Composite Rating gathers five specific proprietary ratings into one easy-to-understand rating. The ideal growth stocks have a Composite Rating of 90 or better.

Data Center-Related Investments

Data Center-Related Investments

In February 2022, AMD finished buying Xilinx for $49 billion, paying entirely with its own stock. This move helps AMD grow in the data center market by using specialized chips from Xilinx. As a result of the acquisition announcement, AMD’s stock price went up.

Moreover, in May 2022, AMD accomplished its $1.9 billion investment in distributed computing Pensando Systems. AMD said the deal will boost its data center abilities. AMD stock increased by 6.6% that day.

On 10 July, AMD publicized a deal to buy Silo AI, the biggest private artificial intelligence lab in Europe, for $665 million. Silo AI has created customized AI models, platforms, and solutions for big companies including cloud, embedded, and endpoint computing markets. AMD stock increased by 3.9% after the news.

This article only aims to provide essential information about AMD stock not for an investment purpose. If you are planning to invest in AMD stock then, do your research and invest at your own risk.

Read More:

Nvidia Stock: The Numbers Are Rising Because Of Different Tech Products

Introduction to Hive Technologies and Its Stock