The Tata Technologies IPO got the attention of investors, and checking the allotment status is basically the most important thing after applying.

This article will help you how to check Tata Technologies IPO allotment along with key dates, and all the necessary information.

Keep reading, keep learning!

What is Tata Technologies IPO

It is actually a subsidiary of the Tata group providing engineering services and solutions to an array of industries such as:

- Automotive

- Aerospace

- Industrial machinery

- And more…

The IPO was launched to raise the funds by selling the equity shares to the public. It gave investors an opportunity to buy the stakes in the company.

Key Details Regarding the Tata Technologies IPO

- IPO Opening Date: The IPO went live for subscription on November 22, 2023 and closed on November 24, 2023

- Allotment Date: November 30, 2023

- Price Band: The company has fixed the price band at ₹475 to ₹500 per equity share.

- Lot Size: A minimum of 30 shares aggregate amounting to around ₹14,250 is accepted.

- Total Issue Size: The IPO aimed to raise about ₹3,042.51 crores by way of an Offer for Sale of almost 60,850,278 equity shares.

- Listing Date: Shares were expected to be listed on the BSE and NSE on December 5, 2023.

How to Check Tata Technologies IPO Allotment Status?

How to Check Tata Technologies IPO Allotment Status?

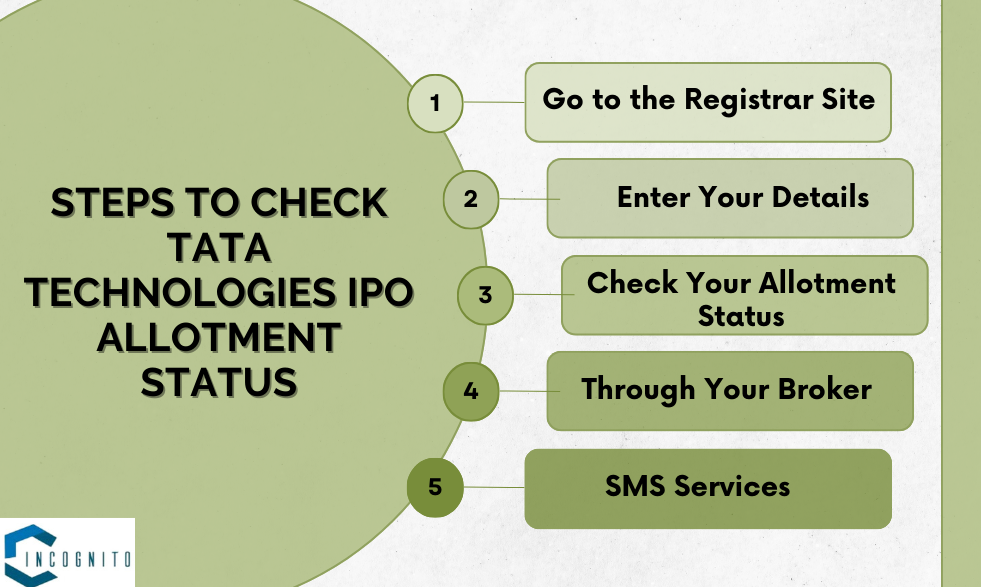

Follow the below steps to check the Tata Technologies IPO allotment status:

1. Go to the Registrar Site:

The allotment status can be checked via the website of the registrar managing the IPO. In this particular case, the registrar is KFin Technologies. This is how to do it:

- Visit KFin Technologies website.

- Visit the page that provides the IPO allotment status check facility .

2. Enter Your Details:

- Enter your Application Number which is a unique number assigned to your application when you have filed for the IPO.

- Alternatively, you can enter your PAN in order to check allotment status.

- Click the “Submit” button after entering this information.

3. Check Your Allotment Status:

Once you fill in all the details, the system will reflect your allotment status. You will come to know whether you are allotted shares or not. Once you have been allotted shares, it will mention the number of shares allotted to you.

Related: What are the Upcoming Government IPO in India

Other Ways to Check Allotment Status

There are other ways also to know your Tata Technologies IPO allotment status if you do not want to sign in on the website of the registrar:

1. Through Your Broker:

Some brokerage houses provide a very easy method to check the allotment status of your IPO directly from their website or platform. To do this follow:

- Go to and log into your trading account

- Under access, go to the section with IPOs or investments

- Find a link or button that says “IPO Allotment Status” or similar

- You will have to give details of your application for all of these

Your broker may have either a direct link or a dashboard feature that makes it quite easy.

2. SMS Services:

Some brokers and financial institutions offer SMS service through which you can track your allotment of IPO. You can look out for such services while you are applying for an IPO or can check the same with your broker if they provide this type of facility.

Related: Top 10 Upcoming IPO in India

Objectives of the IPO

The prime objective of Tata Technologies IPO was an offer for sale, with the objective to give liquidity to the existing shareholders. There was no fresh issue of shares. In other words, the raised funds would not go into the company but would go directly to the selling shareholders, which comprises Tata Motors and other investors.

Conclusion

Allotment status for the Tata Technologies IPO can be checked either on the websites of the registrar or through the brokerage platforms or through SMS services offered by some financial institutions.

Keep your application number and PAN handy so that the whole process is smooth. As there is great interest in this IPO, knowing whether the shares will be allotted to you will help you plan your investment strategy much better.

Remain updated regarding subsequent announcements that are made by Tata Technologies related to listing dates, etc.