Aerodrome Finance has risen to fame in the world of decentralized finance with the promise of offering next-generation Automated Market Maker designed to be the central liquidity hub for Base’s Blockchain ecosystem. It comes with a powerful liquidity incentive engine, vote-lock governance model, and an easily usable interface.

The Rise of Aerodrome Finance

The Rise of Aerodrome Finance

Aerodrome was launched on 28th of August, 2023 on BASE network. It came as a response to the increased demand for a more efficient and user-friendly DeFi platform. In that, the project developers recognized the necessity of a liquidity solution that will easily integrate with the Base blockchain to provide a robust and scalable infrastructure for decentralized trading and asset management.

The major factors that set Aerodrome Finance apart include the liquidity incentive engine. The high-powered mechanism encourages users to provide liquidity to the platform and thus ensures a deep, stable pool of assets for traders. With its rewards mechanism for liquidity providers in place, Aerodrome Finance has tapped into a wide array of participants, such as, anyone from individual investors to large institutional players.

Governance and Decentralization

Governance and Decentralization

The governance model used by Aerodrome Finance is equally impressive. The project, through a mechanism of vote locking, gives AERO token holders the sole discretion for making decisions based on the governance of the platform. Through locking in their AERO tokens for a period, the holders obtain permission to vote, which will finally decide various aspects such as the protocol fee-sharing, the nature of new inclusions, and guiding the platform moving forward.

This decentralized way of governance helps Aerodrome Finance be very responsive to the needs and preferences of the community, creating in users a sense of ownership and engagement. As the platform further evolves, it will be the vote-lock system that plays a major role in deciding what’s next for it, since the development of Aerodrome Finance will then be much more aligned towards the interest of stakeholders.

Liquidity and Trading Efficiency

Liquidity and Trading Efficiency

At the core of Aerodrome Finance’s offering, is its decentralized exchange functionality bringing together the power of automatic market makers for easy token swaps and liquidity provisions. With its complicated algorithms and data-driven models in spread tightening and efficient pricing, it becomes possible for traders to have a user-friendly and cost-effective experience.

A major advantage of the AMM from Aerodrome Finance is that it handles massive trading volumes cleanly without suffering huge slippages or price impacts. This is rather crucial in DeFi, where users take part in large transactions and therefore become highly liquid to undertake their trades effectively.

Have you heard about Vitalik Buterin? Read about this gentleman here

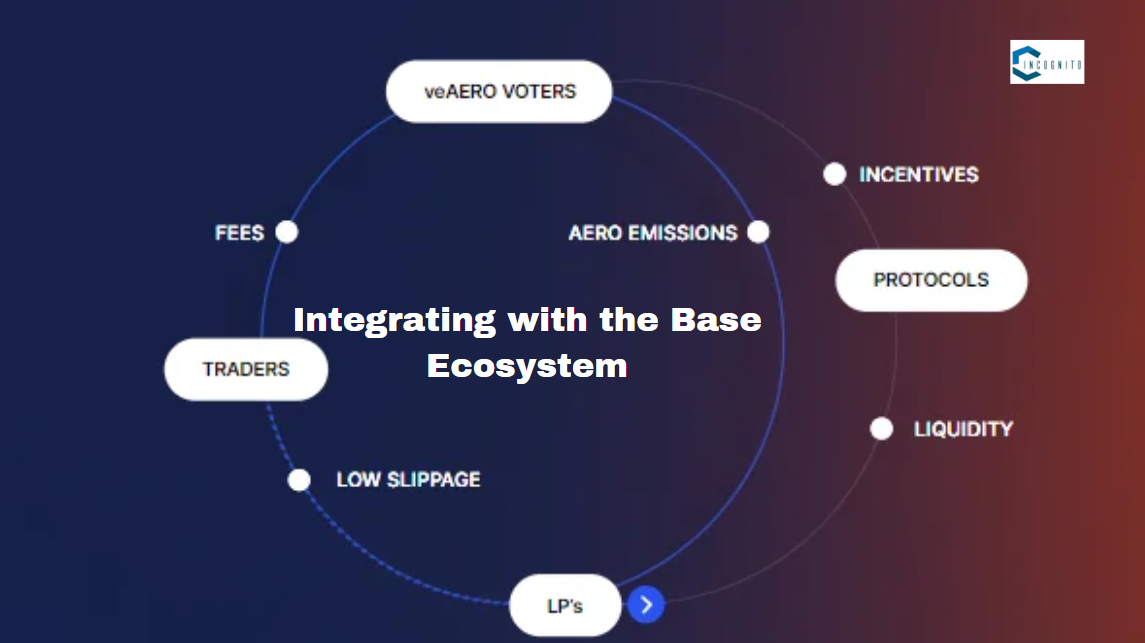

Integrating with the Base Ecosystem

Integrating with the Base Ecosystem

Aerodrome Finance becomes highly important in its value proposition for performing integration with Base Blockchain Ecosystem. Since it is a decentralized exchange built on top of the Base network, it inherits all the scalability, security, and interoperability features of the Base blockchain. In line with that, Aerodrome Finance can leverage the growing Base ecosystem of DApps and protocols in a bid to further expand the asset and trading pairs available to users.

The integration between Aerodrome Finance and the Base ecosystem opens up new opportunities for sharing liquidity across chains and bridging assets. This feature essentially implies that the users have the ability to utilize a wider range of digital assets in this highly connected DeFi environment, enriching user experience and increasing the pool’s liquidity depth.

Challenges and Considerations

Challenges and Considerations

While it’s an undeniable success for Aerodrome Finance, the platform comes with a couple of challenges. Just like any decentralized protocol, it needs to get through the inherent complexities and difficulties of regulatory compliance, security vulnerabilities and the ever-evolving landscape of blockchain technology.

A major consideration is the ability of the platform to run and sustain its liquidity incentive model over the longer term. As the DeFi space is maturing further, it would be intensified by the liquidity providers, therefore needing Aerodrome Finance to constantly fine-tune the incentive structures in line with dynamic market conditions.

In addition, the reliance on the Base blockchain ecosystem creates an added layer of interdependence to be kept under observation. Any high-impact change or disruptive event on the Base network can also disrupt the workings of Aerodrome Finance and change the experience of the end user accordingly.

Interested in Sui Network? Then check out if its worth your attention

How do I store Aerodrome Crypto (Finance)?

How do I store Aerodrome Crypto (Finance)?

The tokens of Aerodrome Finance can be stored in any wallet that supports the token. The following comprise a few:

- Ledger Base Account: You can store AERO tokens in a Ledger Base account. Access the ‘Tokens’ section within your Base account; you will have options to manage your AERO tokens.

- Trust Wallet: It is the other storage available for AERO tokens. Hundreds of different cryptocurrencies, including AERO, can be supported with the wallet.

- Coinbase Wallet: You can be assisted in storing AERO tokens by the Coinbase Wallet. This wallet is highly secure with a friendly interface to users in controlling their AERO balance.

- Metamask Wallet: This is a decentralized wallet with millions of assets and across blockchains. You can store and trade your AERO tokens on it.

- Non-Custodial Wallets: You can store AERO Token in non-custodial or selfcustodial wallets. Such wallets will let you have full control over your private keys.

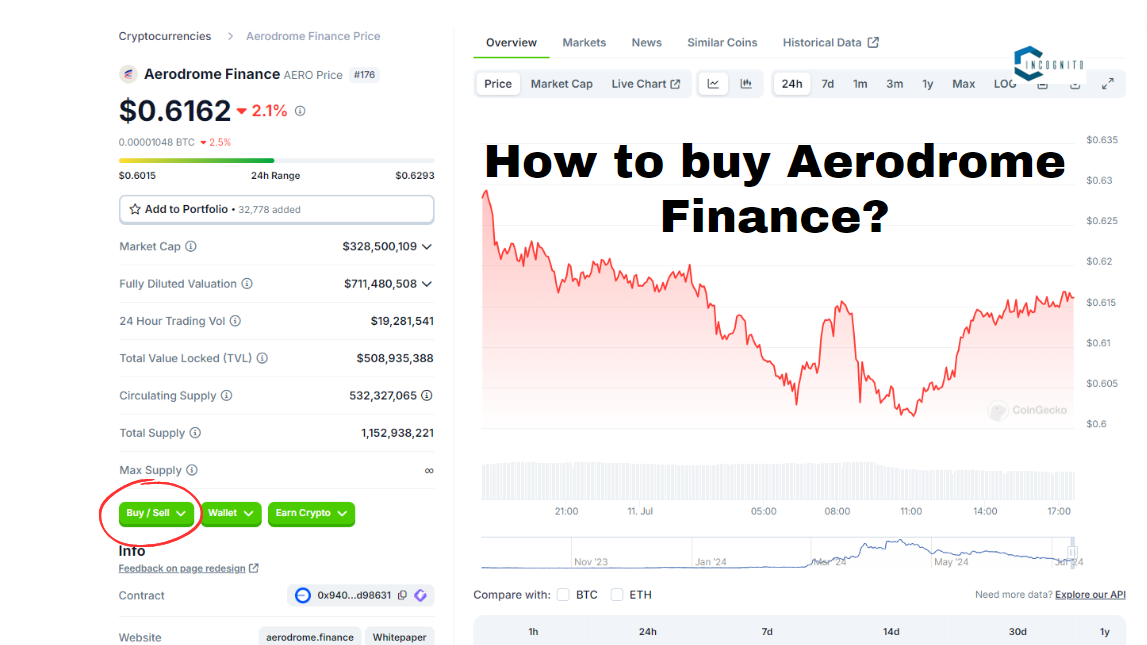

How to buy Aerodrome Crypto (Finance)?

How to buy Aerodrome Crypto (Finance)?

Buying AERO tokens involves the following steps:

- Select an Exchange: Look for and select a trustworthy cryptocurrency exchange that is hosting Aerodrome Finance for trading. Some popular options include Coinbase, KuCoin, CoinEx, and gate.io. Compare them in terms of fees, security, user reviews, and so on.

- Create an Account: Open your account by signing up on their website or mobile application. After that, provide personal information and complete identity verification if needed.

- Fund Your Account: Log in and fund your exchange account with funds via bank transfer, credit card, or debit card.

- Go to the Aerodrome Finance Market: On the exchange marketplace, search for “Aerodrome Finance” (AERO).

- Select a Transaction Amount: Input the desired amount of AERO you want to buy. In this step,

- Confirm Purchase: Preview details of the transaction and click the “Buy AERO” or similar button.

- BOX Transaction Done: Following this, your AERO will then be processed and deposited into your exchange wallet within minutes.

- Transfer to a Hardware Wallet: It is very highly recommended, for security reasons, that you send your AERO tokens to a Ledger or Trezor hardware wallet.

Interested in Meme Coins? Then you must check out the Best Solana Meme Coins

Conclusion

Aerodrome Finance has evolved as a game changer within decentralized finance. A strong incentive liquidity engine, the decentralized governance model, and an easy integration with Base blockchain have combined to set a new benchmark in DeFi. Moving forward, given the ever-changing nature of the industry, it will establish its position further in being one of the major players in decentralized finance through its ingenuous approach toward innovation and dedication to user-needs-driven design.